Exploring the Impact of Bloomberg Opinion Inflation on Markets

Bloomberg has been an influential financial news source since its inception in 1982, providing financial insights and updates to investors and other stakeholders. In recent years, there has been much debate over the potential impact of Bloomberg Opinion Inflation on markets. This article will explore the effects of Bloomberg Opinion Inflation on markets and its implications for investors.

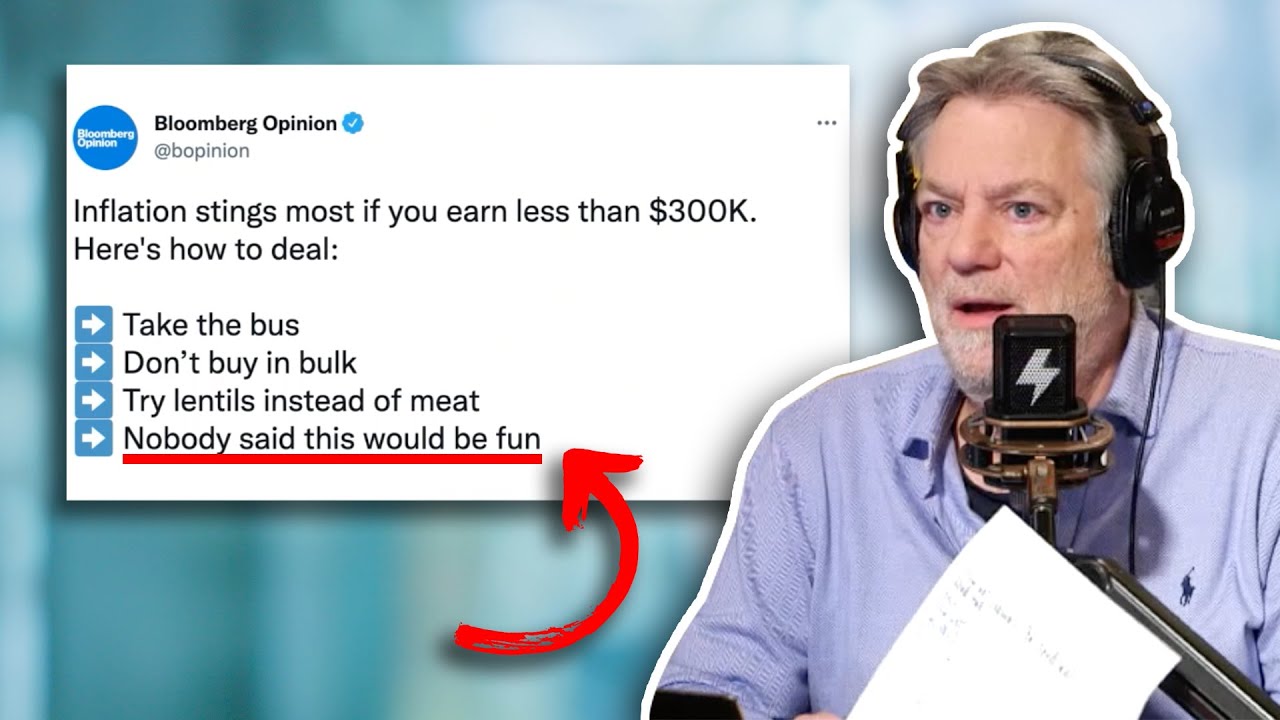

What is Bloomberg Opinion Inflation?

Bloomberg Opinion Inflation is a phenomenon that occurs when the news and opinion pieces published by Bloomberg have an over-inflated impact on markets. This occurs when the news and opinion pieces published by Bloomberg have a more significant impact on markets than the actual news and events. This phenomenon is often seen as a result of Bloomberg’s influence on the markets. When Bloomberg publishes news and opinion pieces, investors may act on it without considering the actual news and events that may be taking place in the markets. This can lead to a situation where the market is driven by the news and opinion pieces of Bloomberg rather than by actual events.

How Does Opinion Inflation Affect Markets?

Opinion inflation can have a significant impact on markets. When investors act on Bloomberg Opinion pieces without considering the actual news and events taking place, this can lead to an overreaction in the markets. This can lead to volatility in the markets as investors may act on the news and opinion pieces published by Bloomberg without considering the underlying fundamentals of the markets. This volatility can lead to significant losses for investors.

What are the Implications of Opinion Inflation for Investors?

The implications of opinion inflation for investors can be significant. When investors act on Bloomberg Opinion pieces without considering the actual news and events taking place, this can lead to an overreaction in the markets. This can lead to losses for investors as the markets may move in a direction that is not supported by the underlying fundamentals. Additionally, investors may be unable to accurately assess the markets due to the overreaction of the markets caused by opinion inflation.

What are the Strategies to Combat Opinion Inflation?

There are several strategies that investors can use to combat opinion inflation. First, investors should be aware of the potential for opinion inflation and should be prepared to assess the markets on the basis of actual news and events. Additionally, investors should be aware of the potential for overreaction in the markets and should be prepared to take a more conservative approach when investing. Finally, investors should be aware of the potential for opinion inflation and should be prepared to limit their exposure to news and opinion pieces published by Bloomberg.

Conclusion

In conclusion, Bloomberg Opinion Inflation can have a significant impact on markets and can lead to significant losses for investors. Investors should be aware of the potential for opinion inflation and should be prepared to assess the markets on the basis of actual news and events. Additionally, investors should be aware of the potential for overreaction in the markets and should be prepared to take a more conservative approach when investing. Finally, investors should be aware of the potential for opinion inflation and should be prepared to limit their exposure to news and opinion pieces published by Bloomberg.