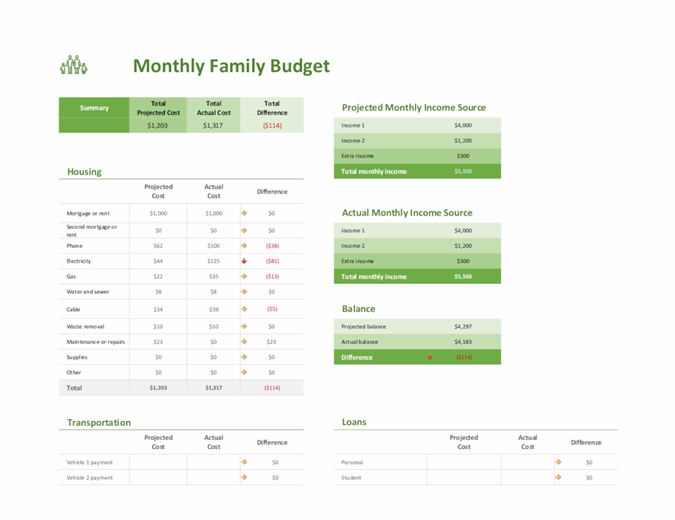

Using an Online Budget Planner to Manage Your Finances

Managing your finances can be a daunting task, but it doesn’t have to be. An online budget planner can help you stay organized and on track with your financial goals. By using an online budget planner, you can easily track your spending, plan for upcoming expenses, and even set up automatic payments to ensure you don’t miss any important deadlines. In this article, we’ll provide an overview of how an online budget planner can help you manage your finances.

Managing your finances can be a daunting task, but it doesn’t have to be. An online budget planner can help you stay organized and on track with your financial goals. By using an online budget planner, you can easily track your spending, plan for upcoming expenses, and even set up automatic payments to ensure you don’t miss any important deadlines. In this article, we’ll provide an overview of how an online budget planner can help you manage your finances.

What is an Online Budget Planner?

An online budget planner is a tool that helps you track your income and expenses, and plan for future expenses. You can use an online budget planner to create a budget, set up automatic payments, and track your spending over time. Online budget planners typically offer features like categorization of expenses, tracking of investments, and even automatic savings plans to help you reach your financial goals.

Benefits of Using an Online Budget Planner

Using an online budget planner has several benefits. First, it helps you stay organized and on top of your finances. You can easily track your expenses, set up automatic payments, and plan for upcoming expenses. This can help you avoid missing payments and ensure that you are staying within your budget. Additionally, online budget planners often offer features like categorization of expenses and tracking of investments, which can help you gain more insight into your finances. Finally, online budget planners can help you save money by automatically transferring funds into savings or investing accounts.

How to Set Up an Online Budget Planner

Setting up an online budget planner is fairly straightforward. First, you will need to sign up for an account. Many online budget planners offer free accounts, but some may require you to pay a fee. Once you’ve signed up for an account, you can start entering your income and expenses into the budget planner. Most budget planners offer features like categorization of expenses and tracking of investments, so you can customize the budget planner to meet your needs.

Tips for Sticking to Your Online Budget Planner

Once you’ve set up your online budget planner, it’s important to stick to it. Here are some tips for staying on track with your budget:

1. Track Your Spending: Make sure to check your budget planner regularly to ensure you’re staying on track with your budget.

2. Set Up Automatic Payments: Set up automatic payments for recurring expenses like rent, utilities, and loan payments. This will help ensure you don’t miss any important deadlines.

3. Set Realistic Goals: Setting realistic goals is key to staying on track with your budget. Make sure to set goals that are achievable and will help you reach your financial goals.

4. Track Your Savings: Tracking your savings is a great way to stay motivated. Make sure to set up automatic transfers to your savings accounts to help you reach your goals.

5. Don’t Be Too Hard on Yourself: It’s important to remember that budgeting takes time and dedication. Don’t be too hard on yourself if you make mistakes or if you don’t reach your goals right away. Just keep working at it and you’ll eventually get there.

Conclusion

By following these tips, you can ensure that you’re staying on track with your budget and reaching your financial goals. An online budget planner can be a great tool for managing your finances and setting yourself up for success.